Tax tips for the individual Forex trader

Fundamental analysis requires an understanding of international economics, and deals with factors as yet unaccounted for by the market. This school of analysis works for investing and long-term trading. Alternatively, when interest rates are cut, all market participants borrow more money.

On the contrary, capital gains occur when you sell an asset for a profit, i.e. at a higher price than its initial price, as in a winning trade. If your capital gains exceed your capital losses, you have a net capital gain. https://en.forexpamm.info/ Similarly, if your capital losses exceed your capital gains, you’re in a net capital loss position. Section 988 allows you to match your net capital losses with other sources of income and clam them as a tax deduction.

A lot of people keep losing money every day by trading Forex. I have created easy to follow trading strategy and include all excel sheets to calculate risk per trade. Technical analysis is a younger form of market analysis that deals only with two variables – the time and the price. Both are strictly quantifiable, accounted for by the market, and are both undeniable facts.

The forex market is the largest and most accessible financial market in the world, but although there are many forex investors, few are truly successful ones. Many traders fail for the same reasons that investors fail in other asset classes.

Many of the factors that cause forex traders to fail are similar to those that plague investors in other asset classes. Only then will you be able to plan appropriately and trade with the return expectations that keep you from taking an excessive risk for the potential benefits. It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run. It is how the trading business performs over time that is important. As such, traders should try to avoid becoming overly emotional about either wins or losses, and treat each as just another day at the office.

They are provided by market makers for informational purposes. Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account.

One big difference is that in forex, you can put in time and actually lose money! But the main difference between a job and forex trading is that once you can consistently make more money than you lose, you can increase your earnings without putting in more time. The reality is that when factoring fees, commissions and/or spreads into return expectations, a trader must exhibit skill just to break even. Let’s assume fees of $5 per round trip trading one contract and that a trader makes 10 round trip trades per day. In a month with 21 trading days, $1,050 will be spent on commissions alone, not to mention other fees such as internet, entitlements, charting or any other expenses a trader may incur in the course of trading.

Paper Trading will not help you

A vendor would recognise this and increase the price of their apples, knowing that both you and your friend will definitely buy all of their apples. This is the ABC of economics, and it is absolutely vital that you, as an aspiring trader, understand the simple logic of this example given, since it will help you to understand how the Forex market works. Most Forex participants use Forex for import and export operations, for international investments, for making money on changing currency prices and for other serious purposes. Most people come to trading for a good life and to have more time to do other things.

Becoming a consistently profitable https://en.forexpamm.info/binary-options-features-advantages-and-disadvantages/ trader is hard enough without the pressure of starting with insufficient capital. Whatever amount you deposit into a Forex trading account should be 100% disposable. That means you can afford to lose the entire amount without it affecting your day to day life. You can still pay all your bills, provide for your family, etc. Forex brokers have offered something called a micro account for years.

The Broker actually profits from providing the best quotes and the tightest spreads. The major participants of the Forex market are commercial and central banks, large corporations and hedge-funds. However, you do not need to have millions or thousands of dollars to start! Due to leverage and marginal trading, you can start trading with $100 or $500 and enjoy the same trading conditions as the large market players.

- Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies.

- This process is usually straightforward but does require a few steps in some cases.

- While leverage can magnify returns, it’s prudent for less-experienced traders to adhere to the 1% rule.

- Because the fact remains that 2% works well with stocks not in forex.

- There are always two prices in a price quote – a bid and an ask.

- Leverage can provide a trader with a means to participate in an otherwise high capital requirement market, yet the 1% rule should still be used in relation to the trader’s personal capital.

So about “How hard is Forex Trading”, now you know how to make a profit in Forex Trading. These are the most important things to earn money by Trading. They show the Supply Demand imbalances in the Trading Scenario and how these move the price. Indeed, the best way to trade is to look for the Trading Price Ranges where the imbalances are the strongest.

Choose from spread-only, fixed commissions plus ultra-low spread, or Direct Market Access (DMA) for high volume traders. Forextrading is not a ponzi-sheme, but there is an other danger that the potential trader should know about. I think it also depends on the country where the trader is located.

This effectively weakens the domestic currency, making exports more competitive in the global market. Central banks, which represent their nation’s government, are extremely important players in the forex market. Open market operations and interest rate policies of central banks influence currency rates to a very large extent.

In the long run, the accumulated bank credit that is generated can potentially create a storm in the form of a financial crisis. National banks are continually trying to balance the scales by periodically raising and lowering interest rates. There are plenty of fish in that ocean, from big to small, depending on their buying power.

When banks act as dealers for clients, the bid-ask spread represents the bank’s profits. Speculative currency trades are executed to profit on currency fluctuations. Currencies can also provide diversification to a portfolio mix. Currency can be traded through spot transactions, forwards, swaps and option contracts where the underlying instrument is a currency.

Without leverage though you may find that you have to risk much less than 1% of your capital. I am still paper trading both futures and forex and will likely open an account in December to start trading forex. Also, the fact that on Instagram at all times they are offering me courses makes me more insecure about trading, since I automatically wonder “If you trade, why do you seem desperate to sell courses at a high price? If you want to day trade forex, I recommend opening an account with at least $2000, preferably $5000 if you want a decent income stream. The forex market forms the essential infrastructure for international trade and global investing.

What Is Respectable Performance for Forex Traders?

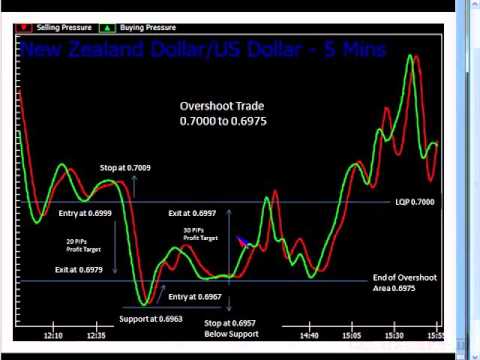

Any analysis technique that is not regularly used to enhance trading performance should be removed from the chart. In addition to the tools that are applied to the chart, pay attention to the overall look of the workspace.

LEAVE A COMMENT