EURUSD Chart

The four-hour, hourly and thirty-minute forex charts, tend to suit traders who like to trade intraday and hold positions for a few hours to a few days. A line chart connects the closing prices of the timeframe you are viewing.

Tools and strategies

As an industry leading forex and contract for difference (CFD) brokerage firm, FXCM understands the active trader’s need to reference timely pricing data and remain cognisant of evolving markets. The Forex Charts offer over 1000 graphs broker Dowmarkets in real-time with Interbank rates (including Commodities and Indices, 22 different time frames and flexible line tools). It also presents a vast range of technical indicators (over 70) as Linear Regression, CCI, ADX and many more.

The colours will either be green or red depending on where it closed. Forex trading charts are available for several pairs and are based on different time frames.

In order to help traders and investors accomplish this task, FXCM presents Forex Charts, a web-based charting application covering an extensive collection of securities and https://dowmarkets.com/ asset classes. Staying abreast of ever-changing conditions in the financial arena can prove challenging, especially when more than one security or market is involved.

Typically, your broker receives market prices from the interbank market and their top-tier liquidity providers – ensuring you are truly connected to the global marketplace. Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Dow theory,as codified by his successors at The Wall Street Journal, is composed of six tenets, which argue that asset prices move based on trends that result from the dissemination of new information.

Before the Internet revolution only large players such as international banks, hedge funds and extremely wealthy individuals could participate. Now retail traders can buy, sell and speculate on currencies from the comfort of their homes with a mouse click through online brokerage accounts. There are many tradable currency pairs and an average online broker has about 40. One of our most popular chats is the Forex chat where traders talk in real-time about where the market is going. Currencies are traded on the Foreign Exchange market, also known as Forex.

This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. The Forex market remains open around the world for 24 hours a day with the exception of weekends. For more on technical analysis and how to use our free trading charts to trade forex and other assets, see our top 3 technical analysis charts for trading.

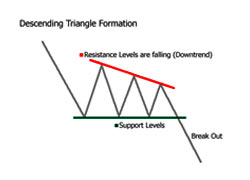

If you are just learning how to trade forex, this list should give you a good overview of how to read primary forex charts. Forex charts also tell you exchange rate levels the market previously reversed to the upside at and below which buyers tend to place bids. These are known as support levels, since the market finds support there when attempting to head lower.

- Trade with a global market leader with a proven track record of financial strength and reliability.

- Below we cover some of the most popular indicators used by currency traders.

New to trading?

They can also be useful for ascertaining whether the market has closed above a key level in a chart pattern, which might signal a breakout. One of the most popular types of charts used by professional forex traders is the point and figure chart. This allows them to filter exchange rate moves, identify clear support and resistance levels and even trade specific patterns.

Currency charts help traders evaluate market behaviour, and help them determine where the currency will be in the future. For forex traders, candlestick charts seem to be the crowd favourite, and it’s easy to see why. With many options for traders to figure out how to follow trends on forex currency pairs as well as commodities and other instruments, the most trusted form would be to follow the charts. Candlestick charts are so-called because it is a block of colour topped and tailed with a thin line which looks like a wick. This is the most popular of the charts with traders as it shows more information than the line chart.

So, when viewing a daily chart the line connects the closing price of each trading day. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types.

When learning how to read candlestick charts it is also worthwhile looking at some of the major types of unique patterns they make, as they help traders in their decision-making process. When viewing OHLC bar charts or candlestick charts, a new bar, or candle, will form once the chosen time period ends. For example, when on a 5-minute chart (M5), a new bar, or candle, will form every five minutes. Within one hour’s worth of trading, 12 M5 bars or candles will have formed.

Forex Fundamental Analysis: An Introduction

It also serves as a trading community; thousands of traders and analysts publish their ideas and forecasts as well as comments and assessments of trade patterns. All three different chart types have unique characteristics, with candlestick charts the most popular among traders around the world. Identifying patterns from candlestick charts – such as a bearish harami or bullish engulfing – can help traders identify possible turning points and the beginning, or end of, market cycles.

While they can never guarantee what is going to happen when it comes to the performance of your chosen pair, it does allow you to act on a more likely outcome. Bar charts are particularly useful for identifying exchange rate gaps where the range of the first time period does not overlap that of the subsequent period.

Multiple chart view

Our trading charts provide a complete picture of live currency, stocks and commodities price movements and underpin successful technical analysis. Follow our trading charts for the latest price data across forex and other major financial assets. Since each bar shows the open, close, high and low prices of a currency, the bar charts are also known as OHLC charts. Even though they are not popular, sometimes traders use these charts if they want to have a quick look at the least amount of data without all the cluttering information. Although there are several types of forex charts, only three are used in common- Line charts, Candlestick charts and Bar charts.

LEAVE A COMMENT